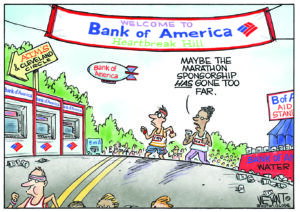

America’s Most Hated Banks

In a list of major banks reviled by Americans in order of volume of complaints, Bank of America takes first place, followed by Wells Fargo, JPMorgan Chase and Citibank.

In a list of major banks reviled by Americans in order of volume of complaints, Bank of America takes first place, followed by Wells Fargo, JPMorgan Chase and Citibank.

The data comes from a project launched in June 2012 by the Consumer Financial Protection Bureau. The idea was to give customers a public place to “lodge complaints against banks and financial institutions they believe are ripping them off,” Erika Eichelberger writes at Mother Jones. As of late July, over 265,000 grievances had been filed. Bank of America was the target of 38,833, Wells Fargo, 26,055 and JPMorgan Chase, 20,057.

Eichelberger reports:

The majority of complaints targeting Bank of America — over 27,500 of them — concern mortgage practices, including foreclosure processing. In 2012, Bank of America, Citi, Chase, Wells Fargo and Ally Bank — the nation’s five largest mortgage servicers — entered into a $25 billion settlement with 49 states and the federal government over the banks’ use of faulty foreclosure documents. (Bank of America recently agreed to pay a fine of $16.6 million to the Treasury Department to settle allegations that it processed nearly $100,000 in transactions for drug traffickers between 2005 and 2009.)

Out of the 26,055 complaints filed against Wells Fargo — which is accused of directing minority borrowers into subprime loans in the lead-up to the financial crisis — close to 6,000 concerned issues consumers had with their checking or savings accounts, including complaints over fees and charges. In 2010, Wells was ordered to pay hundreds of millions of dollars to customers for manipulating debit card transactions in order to rack up overdraft fees.

About 5,100 of the consumer complaints about Citibank concerned mortgages and foreclosures. Earlier this month, the Department of Justice slapped a record penalty on Citi for violations on the investor side of the bank’s mortgage business. The DOJ fined Citi $7 billion for telling investors that the toxic mortgage-backed securities it sold in the mid-2000s were high quality.

Read more here.

— Posted by Alexander Reed Kelly.

Your support matters…Independent journalism is under threat and overshadowed by heavily funded mainstream media.

You can help level the playing field. Become a member.

Your tax-deductible contribution keeps us digging beneath the headlines to give you thought-provoking, investigative reporting and analysis that unearths what's really happening- without compromise.

Give today to support our courageous, independent journalists.

You need to be a supporter to comment.

There are currently no responses to this article.

Be the first to respond.