Argentine Debt Appeal Rejected

The U.S. Supreme Court handed Argentina two major disappointments Monday "in cases brought by bondholders who refused to accept reduced payments after the country’s 2001 default," The New York Times DealBook reports.

The U.S. Supreme Court handed Argentina two major disappointments Monday “in cases brought by bondholders who refused to accept reduced payments after the country’s 2001 default,” The New York Times Dealbook reports:

In a one-line order issued at 9:30 a.m., the court refused to hear Argentina’s appeal of a lower court’s decision requiring it to pay holdouts who did not participate in debt restructurings in 2005 and 2010. About 45 minutes later, the court issued a 7-to-1 decision allowing the bondholders to issue subpoenas to banks in an effort to trace Argentina’s assets abroad.

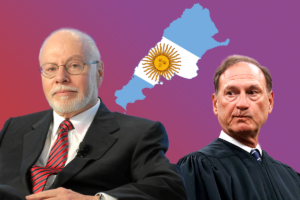

The holdouts include NML Capital, an affiliate of Elliott Management, the hedge fund founded by Paul Singer. It brought 11 lawsuits in federal court in Manhattan to collect the billions it said it was owed, winning each one.

The case the court declined to hear, Argentina v. NML Capital, No. 13-990, concerned the larger question of whether those rulings were correct.

In August, the United States Court of Appeals for the 2nd Circuit, in New York, ruled that Argentina had, in DealBook’s description, “violated a contractual promise to treat all bondholders equally.”

Read more here.

— Posted by Alexander Reed Kelly.

Your support is crucial…With an uncertain future and a new administration casting doubt on press freedoms, the danger is clear: The truth is at risk.

Now is the time to give. Your tax-deductible support allows us to dig deeper, delivering fearless investigative reporting and analysis that exposes what’s really happening — without compromise.

Stand with our courageous journalists. Donate today to protect a free press, uphold democracy and unearth untold stories.

You need to be a supporter to comment.

There are currently no responses to this article.

Be the first to respond.