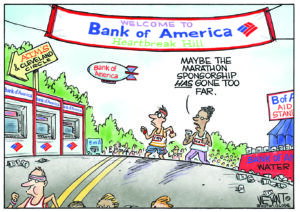

Bank of America Plans New Debit Card Fee

Bank of America announced that it will charge its customers $5 a month for making purchases with debit cards, and Wells Fargo, Chase and SunTrust are poised to follow suit. (more)

Bank of America announced that it will charge its customers $5 a month for making purchases with debit cards, and Wells Fargo, Chase and SunTrust are poised to follow suit.

The fee — which will be waived for the bank’s premium or platinum privileges accounts — is a way to recoup revenue that will be lost from the limitations that the Dodd-Frank Act will place on overdrafts and fees that banks charge merchants for debit card transactions.

“The economics of offering a debit card have changed,” a Bank of America spokeswoman said Thursday. BofA is the largest U.S. bank by assets. –ARK

In these critical times, your support is crucial...The Guardian:

US banks have been looking for ways to increase revenue as regulations introduced since the financial crisis limited the use of overdraft and other fees.

… Senator Richard Durbin, the architect of debit card interchange fee reform, bashed the proposed monthly fee. “Bank of America is trying to find new ways to pad their profits by sticking it to its customers,” he said in a statement.

“It’s overt, unfair, and I hope their customers have the final say.”

As we navigate an uncertain 2025, with a new administration questioning press freedoms, the risks are clear: our ability to report freely is under threat.

Your tax-deductible donation enables us to dig deeper, delivering fearless investigative reporting and analysis that exposes the reality behind the headlines — without compromise.

"Truthdig’s a lifeline for anyone who values democracy especially during these challenging times.”

— Fernando Villamare, Los Angeles, CA

Now is the time to take action. Stand with our courageous journalists. Donate today to protect a free press, uphold democracy and uncover the stories that need to be told.

You need to be a supporter to comment.

There are currently no responses to this article.

Be the first to respond.