Big Banks Cut Jobs, Slash Lending After Billion-Dollar Tax Cut

Just as critics feared, the nation's top financial institutions are rewarding their shareholders at the expense of workers and customers. Mike Mozart / Flickr

Mike Mozart / Flickr

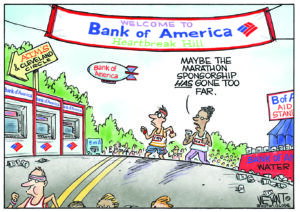

Although big banks in the United States paid $21 billion less in taxes last year thanks to the Republican Party’s push in late 2017 to lower rates for corporations and wealthy Americans, the nation’s top financial institutions used those savings to benefit shareholders rather than workers and customers—just as critics of the #GOPTaxScam had warned they would.

After reviewing financial results and commentary from the 23 banks the Federal Reserve designates as most vital to the U.S. economy, Bloomberg reported Wednesday:

On average, the banks saw their effective tax rates fall below 19 percent from the roughly 28 percent they paid in 2016. And while the breaks set off a gusher of payouts to shareholders, firms cut thousands of jobs and saw their lending growth slow…

While banks vowed to use a portion of their savings to reward employees, help needy communities, and support small businesses, the magnitude of their break and how the money was divvied is likely to fuel debate over whether the law was an effective way to stoke the economy. The 23 firms boosted dividends and stock buybacks 23 percent, and they eliminated almost 4,300 jobs. A few have signaled plans to cut thousands more.

Four of the nation’s six biggest banks—Bank of America, Citigroup, Goldman Sachs, and Morgan Stanley—”paid less taxes than they projected in 2018.” And while employees did receive some bonuses and raises, they were marginal compared with the banks’ windfalls.

MORE: The banks vowed to use their tax savings to give back to employees, but the 23 biggest banks eliminated nearly 4,300 jobs #tictocnews pic.twitter.com/6cRX4anhjG

— TicToc by Bloomberg (@tictoc) February 6, 2019

Meanwhile, as the report detailed, “the biggest winners were shareholders. Tax savings contributed to a banner year for banks, with the six largest surpassing $120 billion in combined profits for the first time. Dividends and stock buybacks at the 23 lenders surged by an additional $28 billion from 2017—even more than their tax savings.”

MORE: The biggest winners of the tax cuts have been shareholders, though.

The 6 largest banks surpassed $120 billion in combined profits, while dividends and buybacks surged by $28 billion in 2017 #tictocnews pic.twitter.com/odomMJzBUL

— TicToc by Bloomberg (@tictoc) February 6, 2019

The analysis spurred outcry from consumer and worker advocates as well as critics of the GOP tax overhaul—about which President Donald Trump infamously bragged, “corporations are literally going wild,” when he signed the bill into law in December of 2017.

“This is the GOP tax cut in action: screwing over working families and handing out tax breaks to large banks and corporations,” the group Patriotic Millionaires said in response to the Bloomberg report.

This is the GOP tax cut in action: screwing over working families and handing out tax breaks to large banks and corporations.

— Patriotic Millionaires (@PatrioticMills) February 6, 2019

Freshman Democratic Rep. Katie Porter (Calif.)—often described as the protégé of Sen. Elizabeth Warren (D-Mass.), a longtime advocate for imposing stricter rules on the financial industry—also turned to Twitter to respond, calling the news “outrageous!”

Let’s get this straight – Wall Street banks got a $21 billion windfall from the #GOPTaxScam while many middle-class Orange County families will see their taxes go up this year? Outrageous! https://t.co/qArdDFZkU2

— Rep. Katie Porter (@RepKatiePorter) February 6, 2019

“It’s time for an economy that prioritizes Main Street Americans, not Wall Street’s biggest banks,” declared the nonprofit Better Markets.

It’s time for an economy that prioritizes Main Street Americans, not Wall Street’s biggest banks…https://t.co/j362X211jp

— Better Markets (@BetterMarkets) February 6, 2019

The report follows a New York Times op-ed, published Sunday, in which Sens. Bernie Sanders (I-Vt.) and Chuck Schumer (D-N.Y.) argued for limiting corporate stock buybacks because the practice doesn’t serve the vast majority of Americans.

As they explained, “large stockholders tend to be wealthier,” and “when corporations direct resources to buy back shares on this scale, they restrain their capacity to reinvest profits more meaningfully in the company in terms of R&D, equipment, higher wages, paid medical leave, retirement benefits and worker retraining.”

Noting that “this practice of corporate self-indulgence is not new, but it’s grown enormously” since the Trump tax cuts, they vowed to introduce “bold legislation” to “prohibit a corporation from buying back its own stock unless it invests in workers and communities first, including things like paying all workers at least $15 an hour, providing seven days of paid sick leave, and offering decent pensions and more reliable health benefits.”

Your support matters…Independent journalism is under threat and overshadowed by heavily funded mainstream media.

You can help level the playing field. Become a member.

Your tax-deductible contribution keeps us digging beneath the headlines to give you thought-provoking, investigative reporting and analysis that unearths what's really happening- without compromise.

Give today to support our courageous, independent journalists.

You need to be a supporter to comment.

There are currently no responses to this article.

Be the first to respond.