End PG&E’s Reign of Error With a Hostile Takeover

Who would head up such a takeover? The public. Fire burns near power lines in Montecito, Calif. (Mike Eliason / Santa Barbara County Fire Department via AP)

Fire burns near power lines in Montecito, Calif. (Mike Eliason / Santa Barbara County Fire Department via AP)

Power companies have two jobs: Keep the lights on and don’t kill your customers. Pacific Gas and Electric Co. of Northern California flunks on both counts.

So how can California put an end to PG&E’s reign of error?

The answer: Make this so-called “public utility” into a true public system—a customer-owned power cooperative, a plan proposed by the city of San Jose. Currently, the only things “public” about PG&E are the bills the public pays and the charred homes and bodies this bankrupt beast leaves behind.

But how can the public take ownership without busting government coffers?

The way Gordon Gekko did it in “Wall Street”: through a hostile takeover bid for PG&E’s stock—now bouncing on the floor at about $4 per share.

It’s been done before, in New York.

For decades, Long Island Lighting Co., LILCO, like PG&E, left millions of its customers in the dark, endangered their safety and emptied their pockets with monstrously high electric bills. Then, in 1998, the customers seized ownership of the renegade utility—at low cost, below its book value.

In 1981, as executive director of the state legislature’s Science and Technology Commission, I was tasked with drafting a law that would allow customers to buy out this dangerous power company cheaply.

Our solution was inventive. LILCO’s stock, like PG&E’s, was in the toilet, trading at a fraction of its book value—that is, way less than the cost of its lines and equipment. If corporate raiders can take over companies cheap to reap giant profits, why couldn’t the state do a hostile takeover to keep the public safe and reduce electric bills?

My agency drafted, and the legislature passed, a law permitting the state to make a hostile tender offer for LILCO’s stock.

To keep the utility’s stock from soaring on the takeover offer, I also drafted civil racketeering (RICO) charges that were filed by the state and local government. The complaint cited years of the company extracting billions from its captive customers on false claims.

A jury awarded Long Island’s beleaguered customers $4 billion in damages. The company, now effectively bankrupted like PG&E, ultimately sold to the state’s newly created Long Island Power Authority at a cost low enough to cut power rates and rebuild the system.

The result: The new publicly owned system rapidly improved reliability and safety, boosted green energy programs, reduced electric bills and even shut down and dismantled a dangerous nuclear plant.

Likewise, California has a good cause to take legal action against PG&E on behalf of its customers. The still-blazing Kincade fire was, the company all but admits, caused by failure on a transmission line the company had promised for two years to fix by this April. It didn’t.

When California Got Ken Lay’d

In olden days, before “deregulation,” your local gas and electric company was not allowed to burn down your house, blow it up, cut off your oxygen tank and then bill you for it.

So what happened?

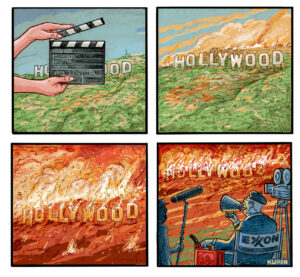

PG&E’s transformation from a public utility into an Academy for Accidental Arsonists began 30 years ago with Ken Lay, chief executive of Enron. Enron, a criminal enterprise parading as a power company, convinced California to lead the nation in “deregulating” its power markets.

Until then, utilities were dull things, controlled like government agencies with highly detailed budgets for operation and maintenance that, when approved by regulators, had to be spent on … maintenance and operations. If they failed to use the money as promised, regulators punished the company with a severe hit to profits already tightly capped by law.

Then, deregulation allowed utilities to pocket unspent money as an efficiency incentive. In practice, deregulation became decriminalization of skimming on safety and reliability.

I can only imagine what Robert “Bat” Batinovich would have done to the company for the deadly delay which likely resulted in the Kincade fire. Batinovich, appointed chairman of the California Public Utilities Commission by Young Governor Jerry Brown, was known as the toughest regulator in America.

Decades later, the Elderly Governor Brown filled the PUC with louche industry buddies dedicated to defending the company except when the TV cameras are on.

What did PG&E do with the maintenance fund embedded in the bills of its captive customers? While those with lives and homes burnt are obvious victims of PG&E’s cost-shaving devil-may-care operations, all of those who pay the monthly bill deserve their day in court.

As we did in New York, the state and local governments should file legal action on behalf of every customer. And that will, justly, cut the price of a takeover.

The Vulture Swoops In

The only thing more dangerous than leaving PG&E in the hands of its current mis-managers is the proposal to give control of PG&E to the financier known as “The Vulture,” Paul Elliott Singer of Elliott Management.

Singer has bought up a hunk of PG&E‘s debt cheaply, and he’s looking to the bankruptcy court to adopt a re-organization plan that would give him a giant payday at ratepayers’ expense.

I’ve been tracking Singer for BBC Television for 12 years.

Here’s how Singer operates. In 2009, Singer and his vulture colleagues bought control of Delphi Corp., which was once General Motors’ auto parts division. Singer’s team threatened to cut off delivery of parts to GM unless the U.S. Treasury paid him billions of dollars. President Barack Obama’s auto bailout chief, Steve Rattner, called it “extortion.”

Obama had no choice but to give in because the parts cut-off would have forced GM’s liquidation, costing half a million jobs. Singer got his billion-dollar payoff, then Delphi shifted almost every union job overseas.

If Singer does a “Delphi“ on PG&E, investment will be cut to the bone to hike profits.

Of special concern to Californians is whether PG&E under Singer’s management would continue to fund its program to reduce pollution and greenhouse gas emissions. Singer is the chairman of the Manhattan Institute, the far-right, climate-change-denying think tank behind the fake trope that the Green New Deal would cost $1 trillion and destroy the economy.

Democracy Is the Solution

There is an alternative for managing PG&E other than the current busload of befuddled bozos or financial vultures.

San Jose has the right idea: consumer cooperative ownership.

Electricity socialism is not so radical: There are 900 power co-ops in the U.S. serving 47 million Americans. And here in Los Angeles, my computer is powered by the city-owned Department of Water and Power, which, while not a stellar enterprise, limits blackouts and tends not to kill its customers—because the mayor must personally answer for the DWP’s failings.

Simply put: Democracy keeps the lights on.

But to keep the cost low and move quickly, local and state governments should take advantage of PG&E’s bargain-basement stock price and the discount on the trading price of its bonds. That, combined with legal action to seek compensation for financially abused ratepayers, should force this un-public utility into the public’s hands at a fair, low price.

___

Before turning to journalism, Greg Palast was a forensic economist, specializing in the investigation of power industry fraud for governments worldwide. He is principal author of the United Nations guide for utility regulators based on his lectures at the Cambridge University department of applied economics.

Your support is crucial...

As we navigate an uncertain 2025, with a new administration questioning press freedoms, the risks are clear: our ability to report freely is under threat.

Your tax-deductible donation enables us to dig deeper, delivering fearless investigative reporting and analysis that exposes the reality beneath the headlines — without compromise.

Now is the time to take action. Stand with our courageous journalists. Donate today to protect a free press, uphold democracy and uncover the stories that need to be told.

You need to be a supporter to comment.

There are currently no responses to this article.

Be the first to respond.