Follow the Money: Big Banks, DOJ Find Benefits in Settlement Deals

The Justice Department might have talked a good game about punishing major banks like JPMorgan Chase, Bank of America and Goldman Sachs for their involvement in the recession that set the the U.S. economy reeling six years ago. But as Lynnley Browning explains in Newsweek there is more to the story behind the big-figure settlements […] Wall Street bull. Photo by Shutterstock

Wall Street bull. Photo by Shutterstock

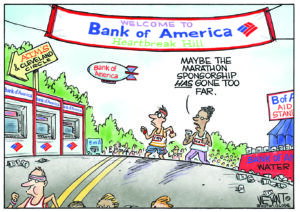

The Justice Department might have talked a good game about punishing major banks like JPMorgan Chase, Bank of America and Goldman Sachs for their involvement in the recession that set the the U.S. economy reeling six years ago. But as Lynnley Browning explains in Newsweek there is more to the story behind the big-figure settlements that the DOJ required those banks to pay:

Because settlements can be deducted from tax liabilities, for nearly every dollar a bank or lender has pledged to pay in cash or pony up in other ways—such as through buying back soured mortgage-backed securities, extending cheaper loans or forgiving failed loans held by struggling homeowners—up to 35 cents will find its way back into bank coffers, a reflection of the 35 percent federal corporate tax rate.

Deep in the legalese weeds of the settlement documents lies buried treasure. Big banks such as Bank of America and JPMorgan Chase will receive deductions against the corporate tax that will amount to between half and nearly three-quarters of their multibillion-dollar settlements, at least. Meanwhile, midsized banks and nonbank lenders generally get to deduct the whole shebang.

[…] Federal tax rules allow companies to deduct from their tax returns as an ordinary cost of doing business any settlement payments that are construed, explicitly or not, as restitution or compensation. Payments flagged as penalties or fines, typically outlined in criminal cases, are generally not deductible, as opposed to the civil settlements with banks.

Bank of America, for example, may be able to deduct around $12 billion out of the company’s $16.6 billion settlement, according to Newsweek’s calculations. Meanwhile, JPMorgan Chase could deduct at least $7 billion of its $13 billion settlement and Citigroup might deduct some $3 billion from its $7 billion deal.

Another unsettling factor in this mix has to do with what the Justice Department stands to gain by appearing to throw the books at the big banks. As Browning explains, “[t]he agency receives a cut of up to 3 percent of its share of the total settlements for its Working Capital Fund, a slush fund common across major government agencies.”

So, these hefty settlements start to look less like justice being served and more like pockets being lined.

— Posted by Donald Kaufman

Your support matters…Independent journalism is under threat and overshadowed by heavily funded mainstream media.

You can help level the playing field. Become a member.

Your tax-deductible contribution keeps us digging beneath the headlines to give you thought-provoking, investigative reporting and analysis that unearths what's really happening- without compromise.

Give today to support our courageous, independent journalists.

You need to be a supporter to comment.

There are currently no responses to this article.

Be the first to respond.