Having ‘Skin in the Game’

Nassim Nicholas Taleb’s new tour de force book "Antifragile: Things That Gain From Disorder" is a frame-of-reference altering work that a Wall Street Journal reviewer confessed he would have to read “again and again”

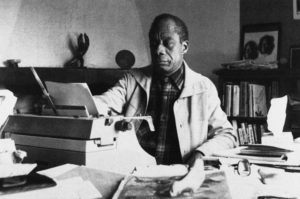

By Ralph Nader

Nassim Nicholas Taleb’s new tour de force book Antifragile: Things That Gain From Disorder is a frame-of-reference altering work that a Wall Street Journal reviewer confessed he would have to read “again and again” presumably to figure out its “somersaults of the mind,” to borrow a phrase from Yoko Ono.

Antifragile, following Taleb’s Black Swan that sold 3 million copies and was a world-wide bestseller, is actually six books in one, as Taleb says. Most reviewers did not comment on “book six” titled “Skin in the Game.” In Washington, D.C. and on Wall Street, the absence of skin in the game is the presence of power without responsibility or vulnerability.

Taleb writes: “The worst problem of modernity lies in the malignant transfer of fragility and antifragility from one part to the other, with one getting the benefits, the other one (unwittingly) getting the harm, with such transfer facilitated by the growing wedge between the ethical and the legal.”

Recognizing the use of self-serving law by the powerful as an instrument of oppression to engage in blatantly unethical conduct, Taleb offers former Secretary of the Treasury, Robert Rubin, as an illustrative. With Bill Clinton, Rubin pressed Congress in 1999 to repeal the Glass-Steagall Act. Just before the repeal’s passage, he resigned and quickly joined Citigroup, the giant financial conglomerate where he was making $40 million within a few months.

It was not a coincidence that Citigroup was the major lobbyist for repealing Glass-Steagall, an FDR-era success, separating commercial banking from investment banking to assure stability and minimize conflicts of interest that were very risky to trusting investors. But, it wasn’t Rubin who took any risks. After disastrously co-directing Citibank’s strategy to the edge of bankruptcy, he proceeded to rack up millions of dollars in bonuses while pushing to make sure that Washington directly bailed out his bank and other financial giants.

Because of Rubin’s avaricious and wrongheaded behavior, pension funds, mutual funds, individual investors, taxpayers and workers all paid the price for the 2008 Wall Street Collapse. Despite this wreckage, Rubin pops up after Obama’s election as part of the group of the president-elect’s leading advisers.

This is what Taleb means when he says this type of “heads I win, tails you lose” privilege is possessed by executives. He adds that “this system is called ‘incentive-based’ and supposed to correspond to capitalism. Supposedly managers’ interests are aligned with those of the shareholders. What incentive? There is upside and no downside, no disincentive at all.” In short, “no skin in the game.”

Likewise, when Congress abdicated their constitutional war-declaring authority to President George W. Bush in 2003, members of Congress and their families had no skin in the game. These politicians who gave Bush the power to unlawfully invade Iraq paid no price. Indeed, they retained their upwardly mobile status. The White House with its mass propaganda machine and the cowardly Congress paid no penalties for violating the Constitution.

Had there been a law requiring the drafting of able-bodied, age-qualified members of their families whenever the government plunged the country into war, these legislators would have had a personal downside. There would have been deliberative public hearings, where some of the hundreds of vocal anti-war retired high military, national security and diplomatic officials would have exposed the Bush/Cheney lies, deceptions and cover-ups leading to catastrophe for the people of Iraq, the U.S. economy, and military families who especially suffered the downsides.

Taleb gives examples from history where high performance came from being forced to have “skin in the game,” as in Roman times when engineers had “to spend some time under the bridge they built – something,” he says, “that should be required of financial engineers today.”

To those who impose political and economic power over the people, we should ask them at every opportunity, do you have skin in the game?”

The virtue of Antifragile is that it is hard to summarize because, in the words of Random House executive editor Will Murphy, it attempts nothing less than to build a guide to thriving – as societies and individuals – in a world too complex to understand: a world governed by the unforeseen events which Taleb, in his previous book, dubbed “Black Swans.”

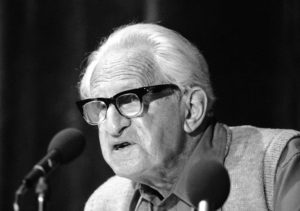

Daniel Kahneman, Nobel laureate and author of the book Thinking Fast and Slow – no slouch himself – says of Taleb’s writings that they “changed my view of how the world works.”

Antifragile, a book drawing on the wisdom of many ancient cultures is an explanation for all ages and all tunnel visions – a boisterous and witty antidote to bureaucratic and individual anomie.

This article was originally published on Ralph Nader’s site, Nader.org.

Your support is crucial…With an uncertain future and a new administration casting doubt on press freedoms, the danger is clear: The truth is at risk.

Now is the time to give. Your tax-deductible support allows us to dig deeper, delivering fearless investigative reporting and analysis that exposes what’s really happening — without compromise.

Stand with our courageous journalists. Donate today to protect a free press, uphold democracy and unearth untold stories.

You need to be a supporter to comment.

There are currently no responses to this article.

Be the first to respond.