How Tax Reporting Is Skewed to Benefit the Rich

Think tanks such as the Cato Institute and the Tax Foundation like to cherry-pick tax data to claim that the rich pay more than their fair share But a broad look at taxation shows it’s not true, a writer at The Economist saysThe Cato Institute and the Tax Foundation like to cherry-pick tax data to claim that the rich pay more than their fair share.

Think tanks such as the Cato Institute and the Tax Foundation like to cherry-pick tax data to claim that the rich pay more than their fair share. But a broad look at taxation shows it’s not true, a writer at The Economist says.

An earlier article in that magazine had noted that in recent years, the top 5 percent of earners received 32 percent of the nation’s adjusted gross income but paid 59 percent of federal individual income taxes. “If that’s not giving something back, what is?” the author had asked.

Yes, most of the American income tax code is progressive, meaning that earners with higher incomes are taxed at higher rates. But income tax is only part of the tax picture, and a small part at that, an article in rebuttal to the earlier one explains. In the whole of the U.S., income taxes account for only 27 percent of total government revenue. That leaves three-quarters of the tax pie for which the argument made by the rich man’s defender does not hold true. That slice consists of the Social Security payroll tax (from which the wealthy are mostly exempt), along with sales and excise taxes. It’s through these taxes that the middle class pays more.

“[T]he American tax code as a whole is almost perfectly flat,” the rebuttal continues. The bottom 20 percent of earners make 3 percent of the income and pay 2 percent of taxes. The middle 20 percent earns 11 percent of the income and pays 10 percent in taxes. And the top 1 percent makes 21 percent of all earnings and parts with 22 percent in taxes.

But that’s not how it has to be. We could live in a world where the rich really do pay as much in taxes as the author of the original article probably led many readers to believe.

— Posted by Alexander Reed Kelly.

Your support is crucial...The Economist:

A charitable interpretation of the position that the rich already pay enough taxes is that its advocates have simply made a good-faith oversight about all those other pesky levies that the vast majority of Americans get stuck with. If they really think that a world where people earning the top 32% of income pay 59% of the taxes is fair, then they should support radical reform to make that a reality.

To start, we’d have to eliminate the flat payroll tax and its $110,000 income ceiling, and replace those revenues with the progressive income tax. We’d also need to tax dividends and capital gains as ordinary income. Then we’d have to modify sales taxes—by, say, taxing things rich people buy, like yachts, at a higher rate than things poor people buy, like generic-brand groceries.

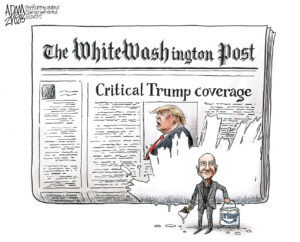

As we navigate an uncertain 2025, with a new administration questioning press freedoms, the risks are clear: our ability to report freely is under threat.

Your tax-deductible donation enables us to dig deeper, delivering fearless investigative reporting and analysis that exposes the reality beneath the headlines — without compromise.

Now is the time to take action. Stand with our courageous journalists. Donate today to protect a free press, uphold democracy and uncover the stories that need to be told.

You need to be a supporter to comment.

There are currently no responses to this article.

Be the first to respond.