L.A. Sues America’s Biggest Bank Alleging Predatory Lending

On Friday, the city of Los Angeles filed a lawsuit against JPMorgan Chase accusing it of pushing minority borrowers to take on risky home loans that would ultimately cost the city at least $1.7 billion in lost revenue and maintenance. JStone / Shutterstock.com

JStone / Shutterstock.com

On Friday, the city of Los Angeles filed a lawsuit against JPMorgan Chase accusing it of pushing minority borrowers to take on risky home loans that would ultimately cost the city at least $1.7 billion in lost revenue and maintenance. According to the city, these risky home loans triggered numerous foreclosures that disproportionately affected people of color. The alleged predatory lending resulted in cratering property values, lost tax revenue and increased costs to the city as there are now no homeowners paying for the maintenance of those foreclosed properties.

The Los Angeles Times reports that JPMorgan is charged with responsibility for some 200,000 foreclosures in the city between 2008 and 2012.

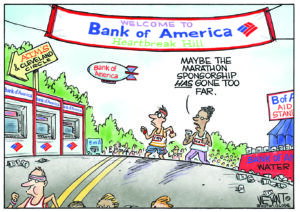

Los Angeles City Attorney Mike Feuer has already gone after Bank of America and Wells Fargo, and will argue that JPMorgan has continuously practiced mortgage discrimination since 2004.

Los Angeles Times:

The JPMorgan lawsuit, like the others, accuses the bank of placing minority borrowers into riskier loans than it did to “similarly situated” white borrowers. Those loans caused a disproportionate number of foreclosures in minority neighborhoods compared to white neighborhoods, according to the city.

When the housing market crashed, JPMorgan then curtailed credit to minority borrowers on a racially discriminatory basis, the lawsuit alleges. If the bank did lend to minorities, it continued to do “so on predatory terms,” the lawsuit alleges.

— Posted by Donald Kaufman and Peter Z. Scheer.

Your support is crucial…With an uncertain future and a new administration casting doubt on press freedoms, the danger is clear: The truth is at risk.

Now is the time to give. Your tax-deductible support allows us to dig deeper, delivering fearless investigative reporting and analysis that exposes what’s really happening — without compromise.

Stand with our courageous journalists. Donate today to protect a free press, uphold democracy and unearth untold stories.

You need to be a supporter to comment.

There are currently no responses to this article.

Be the first to respond.