The Natural Gas Bubble

The natural gas industry is waging an aggressive public relations campaign to bolster investor confidence, despite evidence showing that shale gas is an unreliable resource and that the production process releases large amounts of methane into the atmosphere. The natural gas industry is waging an aggressive PR campaign to bolster investor confidence, despite evidence that the production process releases large amounts of methane into the atmosphere.

By Thomas Hedges, Center for Study of Responsive Law

The natural gas industry is waging an aggressive public relations campaign to bolster investor confidence, despite evidence showing that shale gas is an unreliable resource and that the production process releases large amounts of methane into the atmosphere. Although hydraulic fracturing (or fracking) is in the media’s hot seat, the prospect of a drilling bubble coupled with the underreported problem of methane leakage may be the most destructive qualities of natural gas in the United States.

From commissioning false field reports to flooding television with commercials, natural gas companies are convincing Americans that gas will save the U.S. market; it will not.

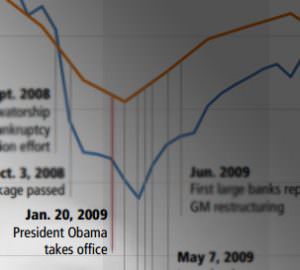

The public relations push is an effort to revive a campaign that started in 2006 and was subsequently killed when the economic crisis hit two years later. Natural gas companies tripled the number of existing wells in those two years, hoping that a glut would attract a large consumer base before raising the prices back up again. Financial companies pumped billions of dollars into the industry, only to see it crumble.

As time passes, data on natural gas production, which goes back only a few years, indicate that shale gas is an unreliable energy source. Reserves are declining up to 70 percent per year. Where corporate reports show that decline leveling off through the use of theoretical models, figures point to an unrelenting decline that predicts the reserves will dry up in a few years.

Financial backers such as Goldman Sachs and AIG are hurriedly funding the development of the natural gas sector to attract other investors before reality sets in. If they fail, the billions of dollars spent from 2006 to 2008 will have been wasted.

These firms are financing energy companies to buy up cheap land, quickly drill wells, label the fields as profitable, and then bundle up those leases and sell them for up to $30,000 per acre to clueless investors. The average acre, according to the founder of Energy Policy Forum and former investment banker Deborah Rogers, is sold to developers for no more than $1,200, and sometimes as low as $100.

These industries are doing the same thing they did leading up to the 2008 crash, only swapping out subprime mortgages for unproved shale gas reserves.

Just as in 2008, companies control the ratings agencies. They “guide” them, arguing that these deals are too complex for the agency to rate by itself.

They’ve created confusing financial products as well, luring investors in with Volumetric Production Payments (VPP), which are indecipherable structures of payments much like derivatives.

The hype surrounding natural gas is a last push to take toxic assets — literally, in this case — dress them up as fancy investments, and then sell them off to unsuspecting Americans.

“Public policymakers need to be very aware of the promotional aspect of shale gas,” petroleum geologist Art Berman says. “This is a very efficient public relations and business machine. They have done a really good job of convincing public policymakers that shale is revolutionary.”

The industry’s reach, many say, infects the Department of Energy and its Energy Information Agency.

Geologists such as Berman and Post Carbon Institute fellow Dave Hughes have looked at figures in the reports and say the conclusions do not match the findings.

“Companies [which influence the EIA] are applying a hyperbolic decline model to the data,” Hughes says, “which is just an equation with different input parameters. It has nothing to do with reality. The only data we have to fit is from four years ago. And then these companies are saying that, after using the hyperbolic model, these wells are going to last for 40 years. So you get a lot of gas but it’s all theoretical.”

A series of emails released in 2011 from within the EIA shows that some employees were skeptical of the agency’s reports.

“The Annual Energy Outlook 2011’s rosy view of shale gas is what you get when the current senior managers’ predilections are in effect and their modeling minions are forced to rely way too much on data from press releases and journalists’ reports, i.e. incomplete/selective and all too often unreal data,” David Morehouse wrote in an April 2010 email to a colleague within the agency.

The oil and gas industry is influential enough that politicians refuse to introduce reform to the agency for fear of losing campaign contributions.

“The [EIA] is corrupt,” says Rogers, who was featured in a 2011 New York Times article “Insiders Sound an Alarm Amid a Natural Gas Rush.” “There’s no way that the Department of Energy and the EIA, which falls under its auspices, is not corrupted by the oil and gas industry. There’s just too much money involved as far as political contributions.

“The EIA has found itself between a rock and a hard place. It’s the same thing that’s happened with the Environmental Protection Agency in a way. The U.S. government isn’t as powerful as the oil and gas industry. It doesn’t have deep pockets. If they come out with anything that’s not favorable to the industry, the industry sues.”

The industry’s public relations exercise is also a grave threat to the green energy movement. As the U.S. seeks to wean itself off oil and coal, scientists say that within the next few years the country must use the interim period to build an infrastructure that supports clean energy.

The campaign for investment in natural gas could distract U.S. policymakers from beginning to fund and build an infrastructure that favors wind, solar and biomass, which climatologists say needs to happen immediately.

Hughes says that, beyond this issue, many scientists say that natural gas is worse for the environment than oil or coal.

A 2011 report from Cornell University found that methane leaks at all stages of the production process, from the wellhead to when you turn on your stove. Methane is 70 times more effective at trapping heat than is CO2, but it escapes the atmosphere faster. In the first 40 to 50 years, gas is worse for the environment than oil or coal. After that, it is cleaner, but Hughes and Berman say gas won’t last half that long.

Hughes says that this corporate campaign has killed a crucial conversation. He says we should be talking about how to couple renewable sources of energy with more mass transit.

“We should be rethinking cities,” he says, “and bringing food production back home.

“The forecasts coming out of the EIA are saying that we can continue to ramp up energy consumption ad infinitum,” he says, “and that’s not a realistic worldview. The average U.S. citizen consumes 22 barrels of oil per year. The average citizen in China consumes 2.8. The average U.S. citizen consumes about five times as much oil as the world’s average. … We can’t keep going on forever.”

This article was made possible by the Center for Study of Responsive Law.

Your support is crucial...As we navigate an uncertain 2025, with a new administration questioning press freedoms, the risks are clear: our ability to report freely is under threat.

Your tax-deductible donation enables us to dig deeper, delivering fearless investigative reporting and analysis that exposes the reality beneath the headlines — without compromise.

Now is the time to take action. Stand with our courageous journalists. Donate today to protect a free press, uphold democracy and uncover the stories that need to be told.

You need to be a supporter to comment.

There are currently no responses to this article.

Be the first to respond.