The Top 25 Hedge Fund Managers Earned $13 Billion in 2015

As many companies lost billions or closed, Kenneth Griffin and James Simons made $1.7 billion each -- more than some nations. Simon Cunningham / CC-BY-2.0

Simon Cunningham / CC-BY-2.0

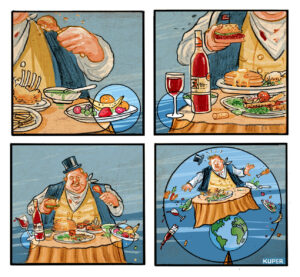

As many companies lost billions of dollars or closed last year, the world’s top 25 hedge fund managers earned a total of $13 billion — more than the entire economies of Namibia, the Bahamas or Nicaragua.

Kenneth Griffin, founder and chief executive of Citadel, and James Simons, founder and chairman of Renaissance Technologies, shared the top spot, taking home $1.7bn each – equivalent to the annual salaries of 112,000 people taking home the US federal minimum wage of $15,080.

The earnings of the best-performing hedge fund managers, published by Institutional Investor’s Alpha magazine on Tuesday, dwarfs the pay of top Wall Street executives who have been under fire for their multimillion-dollar pay deals. The best paid banker last year was JPMorgan Chase CEO Jamie Dimon, who collected $27m. …

Both men have poured a lot of money into the presidential race, but both backed Republicans who dropped out. Griffin, who is the richest man in Illinois with a $7.5bn fortune according to Forbes, has donated more than $3m into the failed campaigns of Marco Rubio, Jeb Bush and Scott Walker.

Griffin, 47, who started from his dorm at Harvard University, was the biggest single donor to Rahm Emanuel’s successful campaign for a second term as mayor of Chicago.

—Posted by Alexander Reed Kelly.

Your support is crucial…With an uncertain future and a new administration casting doubt on press freedoms, the danger is clear: The truth is at risk.

Now is the time to give. Your tax-deductible support allows us to dig deeper, delivering fearless investigative reporting and analysis that exposes what’s really happening — without compromise.

Stand with our courageous journalists. Donate today to protect a free press, uphold democracy and unearth untold stories.

You need to be a supporter to comment.

There are currently no responses to this article.

Be the first to respond.