Proof That the Rich Have Won America’s Class War

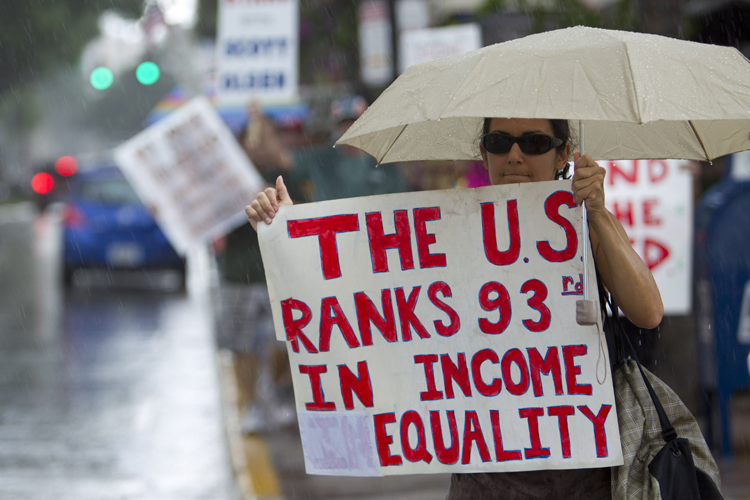

Multiple studies this year show just how deeply inequality prevails the world over. Protesters march against income inequality in Fort Lauderdale, Fla., in 2011. (J Pat Carter / AP)

Protesters march against income inequality in Fort Lauderdale, Fla., in 2011. (J Pat Carter / AP)

Throughout the year, a barrage of studies has uncovered the breathtaking scope of wealth inequality all over the world. Among them was “Public Good or Private Wealth,” the British charity Oxfam’s annual study of global inequality that revealed, among other disheartening statistics, that the fortunes of billionaires increased by 12% in 2018—or $2.5 billion a day. In the same year, the wealth of the 3.8 billion people who make up the poorest half of humanity dropped by 11%. In America, the Federal Reserve and the Government Accountability Office released similarly grim reports.

The Washington Post’s Greg Sargent refers to the situation as “the triumph of the rich … one of the defining stories of our time.” He concludes that at least one cause of this massive inequality is the rapid rise of the individual incomes of America’s top earners. Another cause, he hypothesizes, is the declining progressivity of the tax code—that is, the rich are not only earning more money but paying less in taxes, while wages for the middle class and the poor aren’t rising at the same rate, but they either pay the same in taxes or, in some cases, even more.

While some of us might be stuck in despair mode, willing the numbers on our bank statements to increase or wondering whether it’s time to break out the guillotine, Sargent is proactive, digging deeper into the numbers and finding out what they mean for those of us without trust funds. He contacted Gabriel Zucman, an economist at the University of California at Berkeley and an adviser to Bernie Sanders and Elizabeth Warren. At Sargent’s request, Zucman prepared an analysis to explain Sargent’s theory.

Among Zucman’s findings: “Among the bottom 50% of earners, average real annual income even after taxes and transfers has edged up a meager $8,000 since 1970, rising from just over $19,000 to just over $27,000 in 2018.

“By contrast, among the top 1% of earners, average income even after taxes and transfers has tripled since 1970, rising by more than $800,000, from just over $300,000 to over $1 million in 2018.

“Among the top 0.1%, average after-tax-and-transfer income has increased fivefold, from just over $1 million in 1970 to over $5 million in 2018. And among the top .01%, it has increased nearly sevenfold, from just over $3.5 million to over $24 million.”

Sargent elaborates on the taxes and transfers Zucman refers to: “The idea is to show the combined impact of both the explosion of pretax income at the top and the decline in the effective tax rate paid by those same earners—in one result.” Basically, the rich are both earning more in pre-tax income and keeping more of it when tax time comes around.

Zucman and fellow UC Berkeley economist Emmanuel Saez demonstrate this declining effective tax rate trend since the 1960s in their new book, “The Triumph of Injustice.” As Sargent notes, the tax code was actually fairly progressive in the 1950s and 1960s. Now, the top 400 richest Americans pay less than the American working class.

These results are in line with Zucman’s recent study revealing that the wealth of the 400 richest Americans has tripled since the 1980s.

As Christopher Ingraham writes in The Washington Post, those lucky 400 “own more of the country’s riches than the 150 million adults in the bottom 60 percent of the wealth distribution, who saw their share of the nation’s wealth fall from 5.7 percent in 1987 to 2.1 percent in 2014, according to the World Inequality Database maintained by Zucman and others.”

Adding insult to injury, in addition to the studies showing that the rich are getting richer, 2019 also brought us at least one study showing that the rich actually live longer. According to a report from the Government Accountability Office released in September, the benefits for the wealthy in America are accruing not just in their bank accounts, but in their life expectancy. As The New York Times coverage of the report explained, “almost three-quarters of rich Americans who were in their 50s and 60s in 1992 were still alive in 2014. Just over half of poor Americans in their 50s and 60s in 1992 made it to 2014.”

Read Sargent’s full analysis here.

Your support is crucial…With an uncertain future and a new administration casting doubt on press freedoms, the danger is clear: The truth is at risk.

Now is the time to give. Your tax-deductible support allows us to dig deeper, delivering fearless investigative reporting and analysis that exposes what’s really happening — without compromise.

Stand with our courageous journalists. Donate today to protect a free press, uphold democracy and unearth untold stories.

You need to be a supporter to comment.

There are currently no responses to this article.

Be the first to respond.