Trump Defends Tax Plan, Predicts Economy Set ‘to Rock’

He suggests the plan, expected to pass in Congress in coming days, could lead to explosive growth. But many economists are doubtful, and critics warn of its effect on the U.S. debt.WASHINGTON — Closing in on the first major legislative achievement of his term, President Donald Trump on Saturday defended the Republican tax cut as a good deal for the middle class while boldly suggesting it could lead to explosive economic growth.

The legislation, which the GOP aims to muscle through Congress next week, would lower taxes on the richest Americans. Benefits for most other taxpayers would be smaller, but Trump attempted to sell the bill as a “Christmas present” for middle-class Americans in part because it would trigger job growth.

“It’ll be fantastic for the middle-income people and for jobs, most of all,” Trump told reporters on the White House lawn before traveling to Camp David for the weekend. “And I will say that because of what we’ve done with regulation and other things our economy is doing fantastically well, but it has another big step to go and it can’t take that step unless we do the tax bill.”

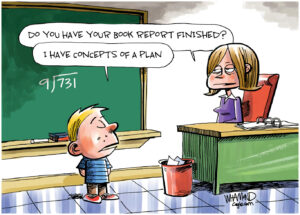

No stranger to hyperbole, Trump also predicted the legislation would cause the economy to soar beyond its current 3 percent rate of growth.

“I think we could go to 4, 5 or even 6 percent, ultimately,” the president said. “We are back. We are really going to start to rock.”

Many economists believe that attaining consistent 4 or 5 percent annual growth would be challenging. The nation last topped 5 percent growth in 1984.

The Republican plan is the widest-ranging reshaping of the tax code in three decades and is expected to add to the nation’s $20 trillion debt. The tax cuts are projected to add $1.46 trillion over a decade.

Under the bill, today’s 35 percent rate on corporations would fall to 21 percent, the crown jewel of the measure for many Republicans. Trump and GOP leaders had set 20 percent as their goal but added a point to free money for other tax cuts that won over wavering lawmakers in final talks.

“This is happening. Tax reform under Republican control of Washington is happening,” House Speaker Paul Ryan of Wisconsin told rank-and-file members in a conference call Friday. “Most critics out there didn’t think it could happen. … And now we’re on the doorstep of something truly historic.”

The bill would repeal an important part of President Barack Obama’s Affordable Care Act — the requirement that all Americans have health insurance or face a penalty — as the GOP looks to unravel a law it failed to repeal and replace this past summer. It came together as Republicans cemented the needed support for the overhaul, securing endorsements from wavering senators.

Marco Rubio of Florida relented in his high-profile opposition after negotiators expanded the tax credit that parents can claim for their children. He said he would vote for the measure next week.

Sen. Bob Corker of Tennessee, the only Republican to vote against the Senate version earlier this month, made the surprise announcement that he would back the legislation. Corker, the chairman of the Senate Foreign Relations Committee, has repeatedly warned that the nation’s growing debt is the most serious threat to national security.

“I realize this is a bet on our country’s enterprising spirit, and that is a bet I am willing to make,” Corker said.

The bill embodies a long-standing Republican philosophy that a substantial tax break for businesses will trigger economic growth and job creation for Americans in a trickle-down economy. Skeptical Democrats are likely to oppose the legislation unanimously.

“Under this bill, the working class, middle class and upper middle class get skewered while the rich and wealthy corporations make out like bandits,” said Senate Minority Leader Chuck Schumer of New York. “It is just the opposite of what America needs, and Republicans will rue the day they pass this.”

The bill would drop today’s 39.6 percent top rate on individuals to 37 percent. The standard deduction — used by around two-thirds of households — would be nearly doubled, to $24,000 for married couples.

The $1,000-per-child tax deduction would grow to $2,000, with up to $1,400 available in IRS refunds for families who owe little or no taxes. Parents would have to provide children’s Social Security numbers to receive the child tax credit, a measure intended to deny the credit to people who are in the U.S. illegally.

Those who itemize would lose some deductions. The deduction that millions use in connection with state and local income, property and sales taxes would be capped at $10,000. That’s especially important to residents of high-tax states such as New York, New Jersey and California. Deductions for medical expenses that lawmakers once considered eliminating would be retained.

The bill would allow homeowners to deduct interest only on the first $750,000 of a new mortgage, down from the current limit of $1 million.

People who inherit fortunes would get a big break. The bill would double the exemption, meaning the estate tax would apply only to the portion of an estate over $22 million for married couples.

Members of a House-Senate conference committee signed the final version of the legislation Friday, sending it to the two chambers for final passage next week.

Republicans hold a slim 52-48 majority in the Senate, and two ailing GOP senators missed votes this past week.

John McCain of Arizona, who is 81, is at a Washington-area military hospital being treated for the side effects of brain cancer treatment, and 80-year-old Thad Cochran of Mississippi had a non-melanoma lesion removed from his nose earlier this week. GOP leaders are hopeful they will be available next week.

___

Associated Press writer Marcy Gordon contributed to this report.

___

Follow Lemire on Twitter at http://twitter.com/@JonLemire and Ohlemacher? at http://twitter.com/@stephenatap

Your support matters…Independent journalism is under threat and overshadowed by heavily funded mainstream media.

You can help level the playing field. Become a member.

Your tax-deductible contribution keeps us digging beneath the headlines to give you thought-provoking, investigative reporting and analysis that unearths what's really happening- without compromise.

Give today to support our courageous, independent journalists.

You need to be a supporter to comment.

There are currently no responses to this article.

Be the first to respond.