Trump Never Had a Grand Strategy for China

Between his arbitrary goals and capricious tariff announcements, it should be clear by now that the president lacks a coherent trade policy. Donald Trump and Chinese President Xi Jinping in Osaka, Japan. (The White House / Flickr)

Donald Trump and Chinese President Xi Jinping in Osaka, Japan. (The White House / Flickr)

President Trump has delayed the new tariffs he threatened to impose on Chinese imports in the early fall, and exempted some other Chinese imports altogether. The de-escalation of the Sino-U.S. trade war is especially welcome, given the markets’ renewed concerns about impending recession. Also striking was the president’s tacit acknowledgment that the tariffs threatened to harm the American consumer (which is probably the closest approximation we’ll ever get to an actual admission of error on his part).

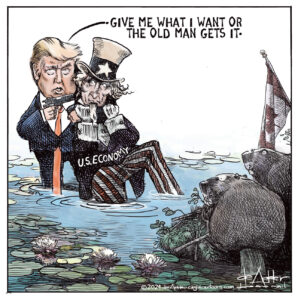

The truth is that we’ve had more than enough time under this “stable genius” to realize that there is no long-term strategic coherence to his trade policies, let alone signs of any “art of the deal.” Rather, the Trump presidency has been characterized by arbitrary goals and capricious tariff announcements that appear to be crafted with a view to securing plaudits on “Fox and Friends.”

Unfortunately, “moderate” Democrats have not been much better on trade. Figures like former Vice President Biden continue to dismiss the competitive threat posed by China’s trade practices, and harken back to supposedly halcyon days of lobbyist-written “free trade” agreements that largely funneled income gains to the top tier. Millions of casualties from hyper-globalized trade have emerged in places like Biden’s own Scranton, Pennsylvania, where the ravages of NAFTA and other trade agreements were ignored by the political class and made proto-fascist politics more appealing.

Many rationales have been deployed by the president to explain his ongoing embrace of the tariff weapon. None, however, fully stack up.

Trump has been compared to previous “tariff men,” such as former Republican President William McKinley, who explicitly campaigned in the 1896 election on a protectionist platform. Like McKinley, Trump has expressed his support for tariffs in nationalistic terms. He sees them less as a tax on the domestic consumer, more a key tool to make American business great again, as well as claiming that tariffs represent a valuable source of government revenue. This appeal to historical precedent is another worn-out lie to justify a stupid policy. As the Washington Post points out, “tariffs haven’t been a major source of U.S. revenue in 100 years,” and Trump himself explicitly exempted certain products from tariff increases until December 15 because of his concern about the costs that they would impose on U.S. consumers as we head into the Christmas shopping season. The revenue generation argument is particularly laughable, coming from a man whose entire working life, both in the public and private sector, has been marked by a complete indifference to debt buildup, let alone fretting about paying it back. It’s a true perversion of history to connect Trump’s tariff legacy in any way to that of McKinley.

Conversely, is the goal to disrupt supply chains and re-domicile them back to the U.S.? If so, then where is his administration’s support for R&D, education, and other industrial policies that could enhance national development, thereby making the U.S. a more attractive place to reclaim high valued-added supply chains? For example, Apple CEO Tim Cook, justifying his company’s decision to manufacture iPhones in China, pointed to the abundance of skilled manufacturing labor in that country, along with Beijing’s decision to emphasize vocational training at a time when the idea has been virtually abandoned in the U.S. This a problem that predates Trump, but the president has done nothing to rectify the deficiency. In fact, his secretary of education is viscerally hostile to the very concept of publicly funded education (of any kind), as well as being a shill for charter schools and privatized voucher programs (in which her family has vested economic interests).

As Robert Atkinson and Michael Lind argue in a recent American Affairs article, “Trump proudly touts his tax cutting and deregulation prowess, while his budgets slash support for key national investments in building blocks like research and development, manufacturing support programs, infrastructure, and education and training.” This comes at a time when America’s infrastructure is already one of the worst in the developed world.

Does the president just want to offer American businesses a temporary respite from hostile Chinese mercantilism via tariffs? If so, his tariffs have hitherto been singularly unsuccessful in stopping Beijing’s mercantilist efforts to try to maximize global market share by dumping below cost until its foreign rivals are driven out of their home markets. Furthermore, as recent events have illustrated, there is little Trump can do if and when China devalues its currency to offset the impact of the increased tariff charges he has introduced (or threatened to revive).

Is Trump concerned about national security? U.S. lawmakers and intelligence officials have claimed, for example, that both Huawei and ZTE could be exploited by the Chinese government for espionage and sanctions-busting respectively, presenting a potentially grave national security risk. Yet the president has often appeared prepared to ignore these concerns, in the interests of using these companies as trade bargaining chips, designed to secure some additional purchases of American soybeans or, more generally, as part of a bigger trade deal.

To be sure, some of the president’s criticism of the historic status quo in trade is valid, as the post-industrial wastelands strewn across the country illustrate. China’s entry into the World Trade Organization had a profoundly negative impact on U.S. manufacturing jobs. We therefore need a national development strategy that breaks with many of the shibboleths of the so-called “Washington Consensus.” As I’ve written before, the policy goal should be to “change the labor share of the production equation, so that production vastly increases general welfare and living standards for the largest possible majority of people. By conducting policy with a view toward favoring labor over capital, the aim is to produce a larger economy, and more stable (albeit restrained) profits.”

Historically, America has not always approached things simplistically through the lens of the free market/market fundamentalist paradigm. After World War II, figures such as A.A. Berle and John Kenneth Galbraith advocated global cartels in commodities to raise incomes in developing countries, and thereby become additional sources of demand for American manufacturers. They also looked benignly on transnational industrial cartels at home in the U.S. Berle, Galbraith and others were advocates for local content requirements so as to sustain America’s industrial ecosystem. And they favored buffer stocks to reduce global booms and busts.

If Elizabeth Warren and her team better appreciated this history (and Warren is the leading Democrat offering a significant reassessment on American trade policy today), they would see that there is a rich counter-tradition that goes beyond a mindless resort to tariffs or simply breaking up successful multinational companies that are among America’s most profitable. Warren and others might reassess the virtues of selective cartelization and cooperation. She and other Democratic presidential candidates could give consideration to constructing a size-neutral regulatory framework to ensure that such companies operate in the interest of national economic strategy consistent with military security and widespread prosperity in order to obtain maximum benefits for American workers and regions. As venture capitalist Peter Thiel has recently argued, it is perverse for Google to refuse to do business with the U.S. Pentagon, while conducting artificial intelligence work in China, which uses AI to sustain its own authoritarianism and mass surveillance.

Embracing national champions does not mean supporting inefficient state white elephants that dole out political favors. There is a large body of research from Joseph Schumpeter onward to suggest that large enterprises are usually the leading avatars of innovation and productivity. Moreover, small and medium enterprises (SMEs) can also reap benefits of scale by pooling R&D, exporting marketing boards, etc., as alternatives to mega-mergers. Government can also play a significant role here, at a minimum by upping research and development expenditures (at its peak during the 1960s, federal government R&D was more than 2 percent of GDP but is now less than half of that).

Likewise, Big Three tripartism—a form of economic collaboration amongst businesses, trade unions, and national governments—should be further embraced to enhance economic prosperity and cope with the challenges of state-sponsored Chinese mercantilism. Both market fundamentalists and pro-business oligarchs like Trump may dismiss collective bargaining as another kind of labor cartel (the Clayton Antitrust Act, however, exempted unions from antitrust). One can be both pro-business and pro-labor (i.e., pro-“national developmentalism”), as Warren appears to be. There is nothing inherently contradictory in terms of favoring limited pooling in employer federations that can bargain with unions, R&D consortiums, export consortiums, etc., while allowing these entities to retain their identity even as they compete with one other. Policies can also be designed to compensate for the higher cost of labor in SMEs via Fraunhofer industrial extension services that enable small producers to compete on the basis of technology, not low wages.

Enough with the “tariff tantrums.” Or the silly idea that a modern economy can forfeit manufacturing to its rivals and specialize in finance, entertainment, tourism, and natural resource industries like farming, while making empty pledges about retraining and relocation to help the “losers” of global integration (promises seldom kept). We have a domestic crisis, and must do better than simply retreat to the delusions of neoliberalism or mindless protectionism if the American people are to come out as winners in a viable future trade framework with Beijing and the rest of the world.

This article was produced by Economy for All, a project of the Independent Media Institute.

Marshall Auerback is a market analyst and commentator.

Your support is crucial...As we navigate an uncertain 2025, with a new administration questioning press freedoms, the risks are clear: our ability to report freely is under threat.

Your tax-deductible donation enables us to dig deeper, delivering fearless investigative reporting and analysis that exposes the reality beneath the headlines — without compromise.

Now is the time to take action. Stand with our courageous journalists. Donate today to protect a free press, uphold democracy and uncover the stories that need to be told.

You need to be a supporter to comment.

There are currently no responses to this article.

Be the first to respond.